Ideally, only take LTF (lower time frame) trades in the direction of the HTF (higher time frame)Īlso, the long term positioning of EMAs helps avoiding whipsaw trades (whether 14/50 EMA are above or below the 200 EMA on the daily chart). Lower timeframe is more subject to noise and false signals, so it’s not recommended under 1h.

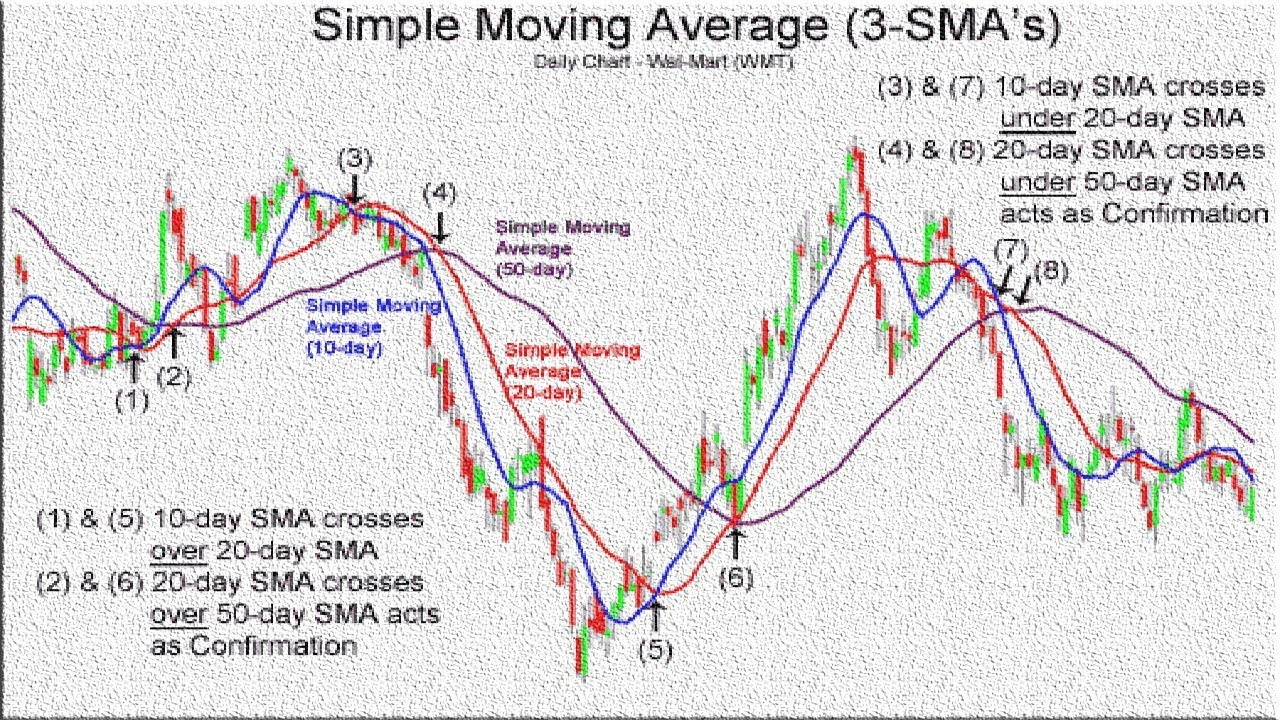

If you’re in an overall sideways market, you may want to drop down to a timeframe or two to do shorter term EMA crossovers (4h or 1h).īCH is an example of where this strategy would get whipsawed in a sideways trading range, without catching a substantial uptrend.ĮMA crossovers work on any timeframe, you can use lower time frames for shorter trades and higher timeframes for longer. EMA crossovers work best in trending markets. Convergence and divergence occur if both the moving averages move in opposite directions. if they move away from each other, they are in divergence. If both the EMA move towards each other, they are in convergence with each other. This happens in times of sideways consolidation. The direction of both moving averages provides further details about the trend. That is, it may signal Buy only to signal Sell soon afterwards. This strategy, like many others using indicators, has a weakness – it may lead to whipsawing. (note that our performance calculations use closing price one day after crossover day, to be conservative) Here’s it’s clear: when EMA 12 crosses below EMA 50, or hits our Stop Loss level.

Often, timing trade exit (at a loss or profit) is the toughest part. The great part about this approach is that it gives clear trade entry and exit signals. Answer (1 of 2): The Exponential Moving Average (EMA) is a technical indicator used in trading practices that shows how the price of an asset or security changes over a certain period of time.

50 and 200 ema crossover how to#

Volume ($) is above 100,000 (some min liquidity)īelow is a tutorial video on how to create this custom screen.Last Price is above 100% of EMA 12 (this ensures that EMA slope is still up).EMA 12 is below 105% of EMA 50 (it’s a recent crossover and distance between the EMAs is small – 5% of less).You can set up a custom screen in altFINS to catch these opportunities by using these criteria: Place a Stop Loss order (or Alert) below the prior low.This strategy uses the 12 day and 50 day Exponential moving average (EMA). Hence, EMA reacts quicker to price changes. You can read about differences between SMA and EMA in our knowledge base, but in short, EMA puts greater weight on the most recent prices, and thus has less lag than SMAs. Moving Averages (MA) help identify 1) price trends and 2) potential support and resistance levels. Let’s begin with a simple trading strategy using moving average crossovers. These are trend following strategies, not swing trading strategies. SMA crossover (100/200 day) and Stochastic indicator.In the next few weeks, we’ll demonstrate several simple but powerful trading strategies that utilize moving averages and can be implemented on altFINS platform.

0 kommentar(er)

0 kommentar(er)